Tuesday, October 28, 2014

Metro Toronto Zoo

I went to the Toronto Zoo with my sister a couple of Saturdays ago. She has a family pass. In October the Zoo had a promotion where you could take a guest for free. On this particular day that guest was me.

I rarely go to the Zoo. Mostly because it costs so much. A typical adult admission is $28. The last time I went was in March of 2012. I had a voucher I bought from Groupon or one of those similar merchants.

The reason it was so cheap was because it was the off season. We pretty much saw nothing going through the African section. The only animals I saw outside there were the lions, cheetahs and hyenas.

This time it was better. We went on a partially overcast fall day. I was hoping to get a few more outdoor shots of the colourful trees, but that didn't happen. I always take such a long time taking photos and I didn't want to keep my sister waiting any longer than necessary.

We started in the Indomalaya section and went clockwise from there. While there we saw the Indian Rhinoceros, some butterflies, tigers and a couple of bored orangutans.

Next was the African Savanna section. The first animals we saw there were a young giraffe and an older one (its mother, perhaps?). We actually got there at feeding time. One of the keepers hand fed the adult, while the youngster preferred the hay placed in the feeder.

As well as the giraffes, we saw cheetahs, lions, a white rhinoceros, baboons, gazelles, zebra and hippo (among others). This section was the largest.

I have to say, we skipped the Canadian Domain... I mean, we live in Canada already. It's not like the animals there are rare and exotic.

In the Americas Outdoor exhibit we saw the flamingos and the rare Black-handed spider monkey. The flamingos were pretty. I don't know why they couldn't just fly away. The monkeys swung around a bit like monkeys tend to do.

We also saw two jaguars there. They were cute. There was a traditional tan-coloured one with black spots as well as an all-black one. They played around with each other like big house cats, rolling around and licking each other and stuff.

In the Tundra Trek section we saw the European reindeer, Arctic fox and polar bears. I believe the young bear we saw was Humphrey. He's around two-years-old I think. I first saw him a couple of years ago when he was a cub. He was really adorable then.

The second last exhibit we saw was the most special. It was the Giant Pandas. There were two of them - Er Shun (the female) and Da Mao (the male). They were kept separate. I don't know who was who.

The first one we saw was kind of far off at the back side of its pen behind some of its play apparatus. The second one was situated more in the open, walking around its pen. Everyone had a good view of it, so that was cool.

We finished off in the Australasia section. There we saw a lone Komodo dragon, some seahorse and jellyfish in the indoor section. Outdoors we saw some wallabies and kangaroos.

It was a good way to spend a Saturday afternoon. Nice to get a walk in, see some interesting animals and take a few shots.

Friday, October 24, 2014

Sad Days for Canada

We've had a couple of sad and tragic incidents here in Canada recently. Two Canadian soldiers were murdered in cold blood by two lowlife cowards.

The perpetrators were what I'd call homegrown terrorists with twisted ideologies. I'd be willing to bet they were ISIS/ISIL sympathizers. Ever since Canada agreed to support the coalition in the fight against this terrorist organization we've come under threat from its supporters.

The first attack happened in St-Jean-sur-Richelieu, Quebec. Warrant Officer Patrice Vincent, 53, and another soldier were run over by Martin Couture-Rouleau. He waited in his car in a parking lot for two hours and when he saw the soldiers (one of whom was in uniform) he ran them over.

Vincent died of his injuries. Couture-Rouleau, was shot and killed by police after a high speed chase in which he flipped his car.

The second attack happened at the nation's capital, Ottawa. Cpl. Nathan Cirillo, 24, of Hamilton, Ontario was one of two soldiers standing guard at the National War Memorial when Michael Zehaf-Bibeau came up and shot him twice in the back with a rifle. Bystanders attempted CPR, but Cirillo was mortally wounded.

Zehaf-Bibeau continued from the War Memorial to Parliament Hill in a car he had driven there. He exited the car in front of the main gates and stole another one inside the grounds. He drove this one to the Centre Block all the while being chased by the Mounties.

He gains access to the Centre Block where he is confronted by security guards. He shoots one in the foot then continues further into the building. Around the Library of Parliament a gun battle ensues. Zehaf-Bibeau, who is wearing full body armour, is fatally shot here. Kevin Michael Vickers, Canada's Sergeant-at-Arms, is given partial credit for stopping him.

To Cpl. Nathan Cirillo and Patrice Vincent and all the men and women in our Armed Forces you have my utmost respect and admiration. Thank you for your sacrifices in holding up our ideals and keeping our country safe from those who seek to harm us.

Tuesday, October 21, 2014

Hike at Glen Major

We went on a hike at Glen Major Park out in Ajax a couple of weeks ago. I was hoping to see some of the fall colours, but I believe we were a bit early in the season.

We had a small group. It was only Emily, Lawrence and I. I met Emily and Ken for lunch, but Ken couldn't join us because he had to meet up with his mum to view open houses. They've been looking for over a year now.

The trails are out east. I usually take the 401 to Salem Road; go up to Kingston Road; head east to Lake Ridge; and head north to Concession Road 9/Highway 5.

My church friends and I used to mountain bike at Glen Major in the late 90's/early 2000's. We went quite often. There are rolling hills and the trail system is quite extensive. Of course we wouldn't be able to hike as far as we used to ride, but we made a good attempt.

Emily and I got there around 3:00 p.m.. Since we notified Lawrence late it took him an extra half and hour to get there.

Though there were a number of new trails, many of them were still the same. I believe they change them up every now and then so older ones get a chance to regenerate.

Even though I hadn't been there for a number of years, I recognized most of the paths. And for the ones I didn't, there now are markers with small trail maps on them. So we weren't in any real danger of getting lost (unlike the first few times we rode there).

We got back to the cars about 3 hours later having walked nearly 7 kilometres. Despite the fact that it was mostly overcast and the leaves were mostly unchanged, we still had a good walk.

Saturday, October 18, 2014

Nuit Blanche 2014

It's that time of year again. The first Saturday of October. Time for the ninth annual Nuit Blanche. The all-night art/performance festival held here in Toronto.

I've gone every year since it started. And, except for the first year, I've tried to stay out almost all night (if not all night). This year I didn't quite succeed. I packed it in 1-1/2 hours early at 5:30 a.m. By then I was pretty tired having walked 10-1/2 hours through the city.

As I've done over the past year or two, I parked down at my church. This means I started at the AGO (which is less than five minutes away).

Like last year they weren't really ready at 7:00 p.m. (around the official start time). So I headed to the next stop with the intention of returning at the end of my night.

The next stop was a film installation at the east end of the AGO. After that I headed next door to OCAD where they had an installation too.

Next was Nathan Philips Square by 8:37 p.m. There was a lot going on there. It's a big place and a lot of people were there. I even bumped into Changhwan who was volunteering there. He's an international student from Korea studying English here.

Of the nine installations around Nathan Philips Square I took photos of six of them from 8:30 to near 11:00.

The organizers changed things up quite a bit this year. Over the previous few years they closed down much of Yonge Street. As well there were things going on at Yonge-Dundas Square, the Eaton Centre and Ryerson University. This year they were empty. Perhaps participation was down.

Instead of shutting down Yonge, they closed off Queen Street West and part of Spadina Avenue to cars. That's where I headed after City Hall.

Queen Street was absolutely packed. There weren't that many installations along there - only six. Though it lead to many more north on Spadina or, the way I was heading, south towards Fort York. I spent a bit over an hour along Queen taking pics and a bit under an hour along Spadina on my way to Fort York.

It was my first time ever to Fort York. Like Liberty Village, it's a great place for installations. But here they didn't have to worry about keeping residents up overnight with the noise. I guess that's why they stopped having them there a few years back.

There was around a dozen installations at Fort York. The one called Between Doors had a line up to walk through the doors set up there. One of the nicer, more colourful ones was Melting Point which had bright lights "dancing" to music. I was in the area for about two hours to near 3:00.

The next 2-1/2 hours were spent walking back up to my car while checking out six installations in between. It was a long, tiring night. Of course it was fun. I enjoyed taking in all the creative projects and taking pictures of them.

'Til next year.

Tuesday, October 14, 2014

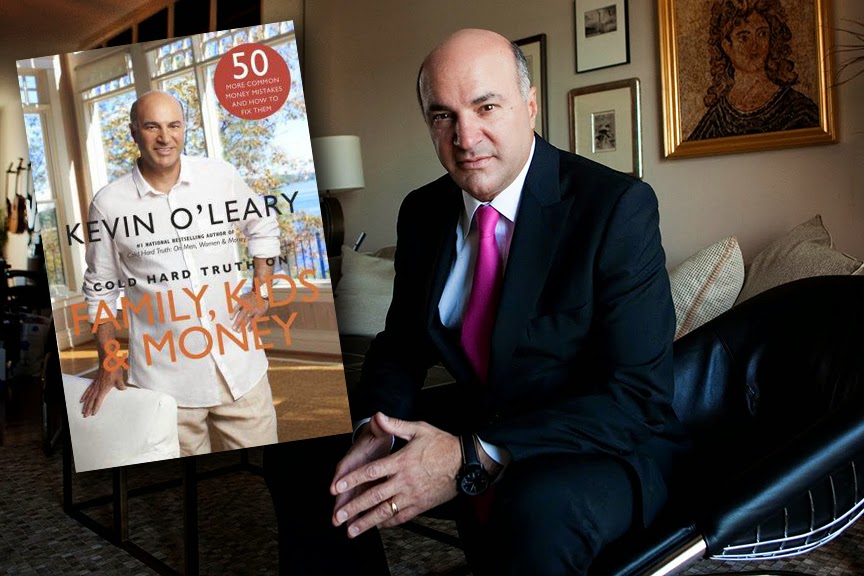

Cold Hard Truth On Family, Kids And Money by Kevin O'Leary pt. 4

Part Four: Family

Chapter 12: All in the Family

This chapter is about small businesses which I’m not really interested in. If you are, you can take the book out from the library.

____________________________

Chapter 13: Hope for the best, prepare for the worst

Make sure you have enough money saved up for retirement. There are a lot of huge costs when dealing with the later stages of life. From unexpected health crises to long-term care facilities things can add up quickly. You have to make sure you’re prepared monetarily.

Costs for long-term care facilities for seniors vary by province. B.C. is one of the less expensive places coming in at $16,243 per year. In Ontario it’s 25,550, which is a little bit above average across the country. O’Leary advocates buying long-term care insurance. I guess that depends on your particular situation.

____________________________

Four questions you need answered before the end (death)

1) Do you have a will? You need a will. Especially if you have dependents.

2) Create a file for your surviving family members. It should include all the steps to take before your will is probated, including tax assessments and a potential phone call to the bank. (If you have money in a joint account with your partner, you may need to notify the bank to make sure the account holder’s names are separate so that your money isn’t frozen in the event that one of you dies.)

Indicate where important documents can be found, such as property deeds, tax papers, insurance and medical claims. You’ll probably want to keep your birth certificate, passport, social insurance number and any other official, hard-to-replace documents in a separate place for safekeeping (like in a safety deposit box at the bank). To be extra safe scan each of these documents so you have digital copies as well.

Write down a list of people who should be notified of your death. People who will need an official copy of your death certificate. These include: the civil authorities in your province, your financial advisor, the lawyer who drew up your will, your pension fund providers, your health insurance, other insurance companies, your various credit card providers, the office that issued your driver’s license and your tax account (if someone else does your taxes). List their names and contact info (phone numbers and e-mail addresses).

If you own real estate, indicate the address and expected resale value of each property. This can help your beneficiaries decide whether to keep, sell or rent the property in question.

3) Have you made funeral arrangements?

4) Have you written down all of your e-mail and social media passwords? Write down the site name, login ID and password for every single site you use (and your computer itself). Bank websites, sites for auto and property insurance, Facebook, Twitter, and any kind of e-mail accounts.

____________________________

Chapter 14: Midlife Crises & Money Mismanagement

Pretty much he’s saying, don’t do anything stupid with your money.

Friday, October 10, 2014

Cold Hard Truth On Family, Kids And Money by Kevin O'Leary pt. 3

Part Three: Kids

Stats Canada says it costs $243,660 to raise a child to age 18. That’s about $1,130 a month. And that’s not including post secondary education which can cost anywhere between $20,000-$64,000 for a four-year degree. If you can’t afford it, don’t have children.

____________________________

Chapter 7: Give your children an MBA (Money and Banking Awareness)

It’s up to you to teach your children about money. O’Leary said when they were young, he tried to instill in his kids two basic principles: money just doesn’t materialize - you have to work for it; and if you don’t have any, sometimes you have to borrow it, and that’s a bad thing. Rarely in life is debt good.

Take your kids grocery shopping with you. Pay with cash so they understand that something left your wallet forever. Invite your kids to the kitchen table with you while you settle the household accounts. Bring them to your next portfolio review so they see how your money is growing.

Don’t spend too much. Mostly save. Always invest.

Things you can do for your children even at a relatively young age - open them a bank account; take them to work with you so they can see how you earn money; get a part-time job (when they’re slightly older).

____________________________

Chapter 8: Kids: Get a Job!

A spoiled, pampered kid isn’t helping anyone - including him- or herself. Your kids ned a job as soon as they’re old enough to work. Even young teenagers should find ways to be employed (part time, of course, and not in a way that interferes with school). Every job will give your kid a new experience and perspective, both the good and the bad.

In his teens and early 20’s, Kevin O’Leary had many backbreaking jobs that made him appreciate the value of hard-earned cash and a well chosen career. At age 17 he got a summer job planting seedlings for a logging company. It was strenuous work. They had to carry around heavy bags with the sun beating down on them all the while being eaten alive by mosquitos and blackflies.

____________________________

Six Safe Summer Jobs for Teenagers

1) Golf caddy. Most caddies earn between $50-$100 a bag. Your child will have to been on his or her feet 4-5 hours at a time.

2) Summer entrepreneur. If you live in Ontario, your children have access to a program called Summer Company. It’s designed to help young entrepreneurs between the ages of 15-29 start a summer business. Your son or daughter can apply for a $3000 grant. If they are selected they will receive the start-up money as well as advice and mentorship from local business leaders. http://www.ontario.ca/business-and-economy/start-summer-business-students

3) Product merchandiser. At grocer stores they hand out samples as well as stock shelves and take inventory.

4) Camp counsellor/lifeguard.

5) Junior park ranger. Parks Canada (www.pc.gc.ca) offers over 1,000 student jobs across the nation. They typically run from May to September and give students opportunities to work in resource conservation, visitor services, heritage preservation and waterways. Your teenager will gain valuable experience and a great boost to the résumé.

6) Caregiver. Does your teenager have a passion for helping the elderly? He or she will need to be up front about their age and lack of professional training, but there are plenty of positions for non-medical assistants. This could take the form of helping an elderly neighbour or relative, or offering services at a seniors’ facility.

____________________________

Chapter 10: A Letter to your Teenager from Uncle Kevin

You’re never too young to establish credit. You can become an authorized user on your parents’ credit card at age 16. Make small purchases and pay them off fully on time. Never, ever carry a balance. This will help build your credit rating making it easier to get a loan in the future.

Be safe when concerning sex. As stated before, children cost $243,660 from diapers to diploma. Guys, you can’t afford to get a girl pregnant. Girls, the cost is much higher for you. The correlation between teen pregnancy and high school dropout rates is huge. If you do drop out of school, the future gets bleaker. According to Statistics Canada, women without a high school diploma make, on average, less than $30,000 a year.

Stay away from drugs. Besides messing up your head, you definitely can’t afford a drug addiction. Period.

You have other options besides going to university. If you don’t think you have the smarts to go to university or it just doesn’t interest you there are many other jobs you can choose from that pay very well. The Conference Board of Canada estimates that 40 percent of all new jobs will be in the skilled trades and technology industry by 2020.

10 Cold Hard Cash Careers:

1) Oil and gas drilling supervisor. Top 50 ranking #1. Median salary: $74,880.

2) Audiologist and speech-language pathologist. Top 50 ranking #11. Median salary: $77,813. This job requires a master’s degree.

3) Construction manager: Top 50 ranking #13. Median salary: $72,800.

4) Registered nurse: Top 50 ranking #16. Median salary: $72,072. This job normally requires at least a bachelor’s degree.

5) Dental hygienist. Top 50 ranking #18. Median salary: $69,992. You must complete either a bachelor program or a dental hygiene diploma to be licensed and registered.

6) Metal-forming contractor and supervisor. Top 50 ranking #21. Median salary: $65,874. Normal Metalworkers make around $55,000.

7) Pipe-fitting contractor and supervisor. Top 50 ranking #23. Median salary: $66,560. A regular Pipe-fitter can make $40-50,000.

8) Electrician. Top 50 ranking #31. Median salary: $68,493.

9) Mining supervisor. Top 50 ranking #43. Median salary: $64,480.

10) Construction inspector. Top 50 ranking #48. Median salary: $62,400.

____________________________

Chapter 11: A Letter to your 20-Something, from Uncle Kevin

In the new reality of 2014 youth unemployment is currently at a sky-high 19.6 percent. If you can’t find a regular full-time job you may have to create your own opportunities. If you have a skill set find a way to monetize it. You might end up as a freelancer working part-time for different employers. Or, perhaps, you’ll find a niche as a consultant. In 2012, 29 percent of Canadians between ages 20-24 were employed in temporary positions.

Open a RRSP. Even if you contribute a small amount it all adds up. RRSPs are a tax deferral program. You only pay taxes when you withdraw the money from the RRSP after you retire.

(This is advice from me). Consider putting away money in a TFSA (Tax Free Savings Account). It’s sort of the opposite of an RRSP. Currently you can put away up to $5,500 a year. Any interest/capital gains you earn on your investments are tax free.

Don’t buy things to make yourself feel good (shopping therapy). A lot of people do it. Big mistake. All those seemingly small purchases add up.

Don’t overshare on social media. Saying the wrong thing or posting inappropriate pictures can hurt your chances of employment if the wrong people see it. Be cautious.

Don’t over-educate yourself to avoid setting foot in the real world. More/higher degrees doesn’t necessarily mean higher income. Especially if getting a job in your particular field of expertise is rare. All you’re accomplishing is putting yourself deeper in debt and wasting time you could be using to potentially generate income.

Sunday, October 5, 2014

Cold Hard Truth On Family, Kids And Money by Kevin O'Leary pt. 2

Part Two: Marriage

Chapter 4: (What to look for in a mate)

1) Homogamy. noun - Interbreeding of individuals with like characteristics. Pretty much O’Leary is saying, aim to marry someone with a similar sociological background to you if possible.

2) Health. Marry someone who is relatively healthy. Research has shown that couple who exercise together enjoy lower stress levels and greater happiness.

3) Social tendencies. Look for someone who is social. Studies have shown that couples do best when they engage in the larger community, be it through clubs, service organizations or religious groups. Invite friends over for dinner… join a hiking group.

4) Education. The better educated you are the better off your marriage will be.

5) Money. Look for someone who is good with money. A Meanie, who saves, invests and spends within his means.

____________________________

Chapter 5: Establish your Financial Indepdence

Save 10% of your income for future use. Hire a financial planner or broker* separate from your spouse’s . You both need one. If one person ends up losing their money you can rely on the savings/investments of the other. And, in case of divorce, you’ll be protected. A divorce is so much easier if you have your own advisor and your own funds; you’ll be able to split your assets without missing a beat.

*note: Financial planners can only buy mutual funds while brokers can buy stocks and bonds.

Kevin also says you should sign a prenuptial agreement before getting married. (p 213)

____________________________

Kevin O’Leary’s Investment Philosophy

1) Never let a stock, bond, commodity or any investment become more than 5% of your portfolio.

2) Never purchase a stock or bond that does not pay a dividend or interest. In the last 40 years, over 70 percent of stock market returns have come from dividends, not capital appreciation.

3) Keep a balanced portfolio. O’Leary personally keeps his portfolio 50% stocks and 50% bonds. He actually isn’t a good stock or bond picker. That’s why he created O’Leary Funds. He lets the professional managers pick the stocks and bonds he owns and gets a dividend and/or interest check every month.

____________________________

Chapter 6: Build the Bedrock of your Partnership

Setting financial goals, making a plan and sticking to a budget are the mortar that will make a solid, good life possible.

O’Leary suggests calculating all your income (net salary, bonuses, interest/dividends earned etc.) over a 3-month period. Then do the same with all your expenses (rent, mortgage, utilities, insurance, car payments, property tax, groceries, child care, health care, gas, eating out, clothing, entertainment, magazines, donations… even that pack of gum you bought… everything.

Add up your income and minus your expenses. If you’re in the black, good. If you’re in the red, you’re in trouble. It’s time to declare a state of emergency. Eliminate the car you can’t afford. Stop taking vacations. Do not go out to dinner. You have to correct your bad spending habits now.

You only have two financial goals: get out of debt and pay off your mortgage; and keep putting 10% away in your Secret 10 (that’s 10% of your income that you’re putting away and saving for later). For every dollar you earn, 90 cents should go to paying off debt, and 10 cents should go to your Secret 10. The 90/10 rule supersedes everything until you’ve paid off all your debt.

Wednesday, October 1, 2014

Cold Hard Truth On Family, Kids And Money by Kevin O'Leary pt. 1

I'm reading through the Cold Hard Truth On Family, Kids And Money by Kevin O'Leary for the second time. It has some really good advice for people in general (whether or not you're looking to get into a relationship).

Here are the gems I've picked out.

____________________________

Part One: Love

Chapter 1: The Dating Game

For someone of more than modest financial means, Kevin O’Leary is surprisingly stingy when it comes to spending on dates. It’s because he came from humble beginnings where money didn’t grow on trees. He learned to respect it and wants to pass that sentiment along.

____________________________

Love, marriage and kids can provide some of the richest rewards in life - but only if you have a strong financial foundation to support them.

On spending freely while dating - “She won’t love me if I don’t shell out.” Really? If spending your money is her main goal, I’m (O’Leary) giving you free licence to dump her. Now. Cut your losses now. You’ll thank me for it later.

Relationship Due Diligence - Date at least 3 years before getting married. When you first meet you’ll be head over heels with your partner. Your view of them will be skewed. You need time to truly get to know one another; to discover compatibilities as well as potential problem areas. And you need time to figure out if you can work through them or not.

Pay attention to your partner’s spending habits, including how cavalierly they whip out their credit card. And do have important conversations about where you see yourself in the future. You have to articulate your long term objectives and see if they line up with your partner’s.

____________________________

8 Dates that won’t Break the Bank:

1) Take a stroll. Go for a bike ride, take a hike. In the winter rent skates and go skating.

2) Explore a museum or art gallery. Some of them offer free admission on certain days of the month.

3) Do some physical activity together. That’s sort of like number 1. to me.

4) Play board games. Many cities have board game cafés where the price of a coffee or beer will grant you access to stacks of games.

5) Go to lunch or brunch. It’s much cheaper than dinner.

6) Dinner and a movie… at home. Borrow a DVD from the library and make dinner at home.

7) Find a meetup group. You can meet people with common interests and possibly meet someone you click with.

8) Join a free online dating site. Don’t shell out your hard earned money on one with hefty membership fees.

____________________________

Chapter 2: Choosing a Mate

Kevin O’Leary’s advice on getting your potential partner to fill out a “Due Diligence Checklist” before considering them for marriage seems a bit over-the-top to me. It may be a smart and practical, but I doubt it would go over well with him/her. I’d suggest bringing up these topics over time through day-to-day conversation and making note of them instead.

____________________________

Red Flags to Look out for in a Mate:

1) Long-term liabilities. You’re not just marrying your spouse. You’re marrying his or her family and everyone in it. Do they have the ability to look after themselves in old age or will you guys be asked to help finance their long-term care?

2) Potential health problems. Is your partner healthy? Does he/she take care of him/herself? If not, it’s going to probably cost you later.

3) Crushing debt. It could be student loans, medical bills or credit card debt. How much of your partner’s debt you’re willing to accept is up to you. But your partner should be paying down the principal every month and working diligently toward a plan to pay off the debt completely.

4) Past bankruptcy or foreclosure. Do not get into a relationship with anyone who has declared bankruptcy or been foreclosed on. There is no better proof your partner is not good with money and assets than this.

____________________________

Chapter 3: The Five Languages of Money (or Four people to avoid… and One to search for)

Here are the ones to avoid:

1) The Mooch. He’s someone who’s always sponging money off people because “he’s forgotten his wallet.” or some other lame excuse. He always says, he’ll pay you back but never does.

2) The Spendaholic. He’s someone who’s always trying to buy friendship/love. Don’t be fooled. All he’s going to do is end up being in the poor house.

3) The Loafer. He’s someone who has a low standard of living and lacks ambition to aim for more. To me, he sounds a lot like The Mooch. He’s been pampered by his parents and relies on them to bail him out of financial trouble. (Sounds like me?)

4) The Thief. He’s someone who steals money outright or bamboozles people out of what’s rightfully theirs.

Here is the type of person you should be looking to meet:

1) The Meanie. He’s someone who lives within his means. He has a healthy approach to saving and investing money, and he knows how to set a budget and stick to it. He only buys what he can afford otherwise he abstains.

____________________________

Subscribe to:

Posts (Atom)